FlashCash-Quick and Easy Personal Loans

Описание на FlashCash-Quick and Easy Personal Loans

FlashCash, India’s fastest and easiest Instant Loan Platform.

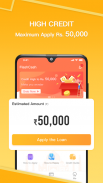

Loans range: ₹2,000 to ₹50,000

Tenure: 62 days to 365 days.

Interest rates range: 0%-29.95% per annum (Depending on the product availed).

Representative Example:

If loan amount is ₹8,000 & the interest is 20% per annum with tenure of 91 days; after deducting any other fees, interest=₹8,000 x 20% x 91/365 = ₹398.

Sign up in 10 seconds, certify yourself in 3 steps, apply for the loan in 5 minutes and get the money directly into your account in a few hours.

Benefits & Risks:

1. Be able to unlock higher amounts & longer tenure as long as you close the loan on time.

2. As compliance requirements, your payment action shall be shared with credit rating bureaus; so that your credit score may increase/decrease accordingly.

Loan Features:

● It's Quick.

Complete the application in 3 steps & Avail the cash in your account in minutes as fast as a lightening.

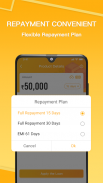

● It’s Flexible.

Select your most preferred product among multiple options and the repayment tenure is range from 62 to 365 days. Both full repayment product and EMI product are available!

● It’s Digital.

Apply for the loan & Repay the loan by a simple click on the app.

● It’s Completely Personal.

No collateral&no guarantors are required.

●It’s User-Friendly.

Both Hindi version and English version are available.

Fees & Charges:

Loans range from ₹2,000 to ₹50,000 with payment tenures of 62 days to 365 days. The charges and repayment tenures depend on the creditworthiness and repayment ability of the customers. A small processing fee and convenience fee is charged for the loans. Overdue Penalty is only charged when someone delays their scheduled payment. In addition, GST will be applicable only on the processing fee and convenience fee components according to Indian laws.

Interest Calculation:

If the principal amount is ₹6,000 and the interest is 24% per annum; and the tenure is 91 days, then the overall interest payable is ₹6,000 x 24/100 x 91/365 = ₹359 only.

Loan Application Process:

As India’s fastest and easiest personal loan platform, FlashCash is 100% app-based from loan application to loan repayment. 3 steps are all you need to go through before the loan arrives in your bank account:

●Verify your personal certification

●Verify your personal information

●Verify your company information

●Upload your ID documents for the ID verification

Eligibility:

✔ Indian resident

✔Salaried Individuals

✔Above the age of 18

✔Minimum monthly salary ₹18000

Operational Cities:

FlashCash is operational all over the India.

How It works:

1. Install FlashCash APP from the Google Play store

2. Register the APP with the PAN-linked number

3. Upload a few necessary details to complete the certification process which usually takes 5-10 minutes

4. The fund will be transferred to your bank account within 10 minutes upon approval.

5.Repay the loan before the due date

Security & Privacy:

Data security & privacy is given top priority at FlashCash. We comply with the highest security standards & protocols. All transactions are 100% secured.